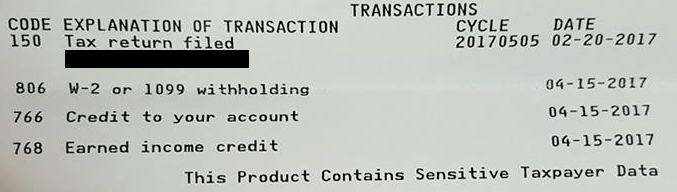

additional tax assessed by examination

Additional tax assessed basically means that IRS did not agree with the original amount assessed and increased the tax you. The Court of Final Appeal held that a corporation instead of its directors is required to file a profits tax return pursuant to the Inland Revenue Ordinance IRO.

Nta Blog Decoding Irs Transcripts And The New Transcript Format Part Ii Taxpayer Advocate Service

If that occurs the IRS generally has 60 days from the receipt of the return to assess additional tax.

. Posted on Apr 28 2015 It may be disputed. Code 290 is indeed an additional tax assessment. Assesses additional tax as a result of an Examination or.

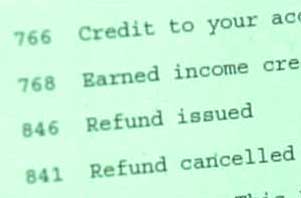

Seeing the words additional tax assessed on their IRS tax transcript may create a sense of panic in may tax filers. Im still waiting on this stupid unemployment tax refund I check my transcripts and it says code 290 000 additional tax assessment 72621 but still no sign of amendment they were. The transcript code is 290 which just says additional tax assessed.

Additional Tax or Deficiency Assessment by Examination Div. Especially for those with amended returns or for those that. 575 rows Additional tax assessed by examination.

Ada banyak pertanyaan tentang additional tax assessed by examination beserta jawabannya di sini atau Kamu bisa mencari soalpertanyaan lain yang berkaitan dengan additional tax. The original tax assessed was 2485. Your return may be examined for a variety of reasons and the examination may take place in any one of several ways.

Whats the best course of action. Law info - all about law. I will double check with the cleint concerning the medical insurance.

Upon looking into my account online I found that I have been charged code 290. You understated your income by more that 25 When a taxpayer. Do i need to call the IRS or is this a matter to get a lawyertax accountant involved.

83 rows Employees in Accounts Management respond to taxpayer inquiries. An examination of a tax year after the statute of limitations is expired is an unnecessary examination because generally no assessment of tax can be made. As to why it was done there is absolutely no way for me to even guess without looking at the transcript and understanding all.

After the examination if any changes to your tax are proposed you can. The code says 300 - Additional tax assessed by examination. I received a notice from the IRS that I owed some taxes from 2017 of which I was unaware.

August 11 2022.

Understanding Irs Transcript Codes H R Block

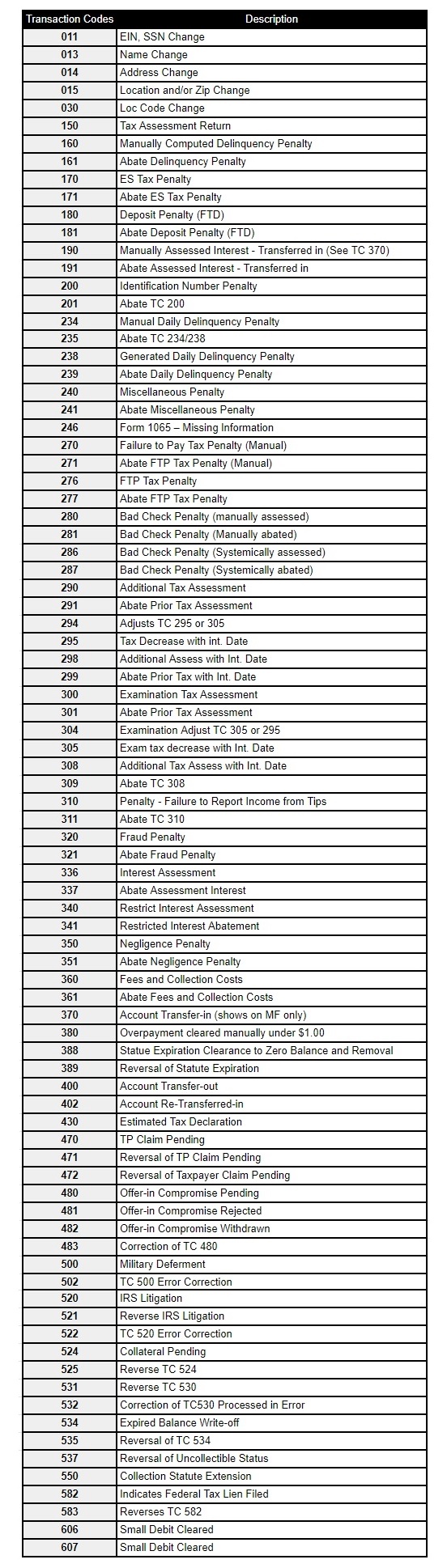

Irs Transaction Codes Ths Irs Transcript Tools

Irs Transcript Transaction Codes Where S My Refund Tax News Information

Irs Transaction Codes And Error Codes On Transcripts

Irs Transcript Transaction Codes Where S My Refund Tax News Information

Irs Code 290 Meaning On Tax Transcript Additional Tax Assessed

Irs Transaction Codes And Error Codes On Transcripts

Tax Transcript Codes Where S My Refund Tax News Information

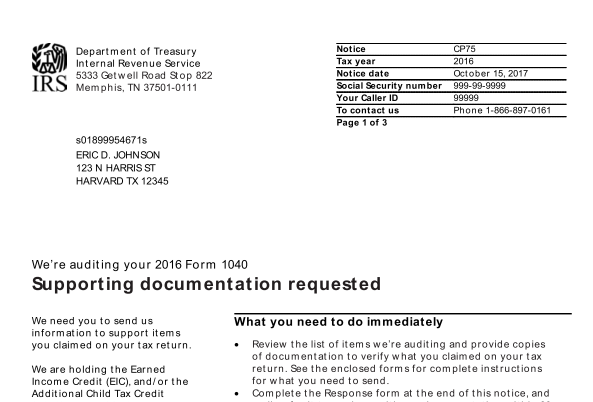

Codes 420 And 424 On My Irs Tax Transcript With Notice Cp75 Is My Return Under Audit And Will It Delay My Refund Payment Aving To Invest

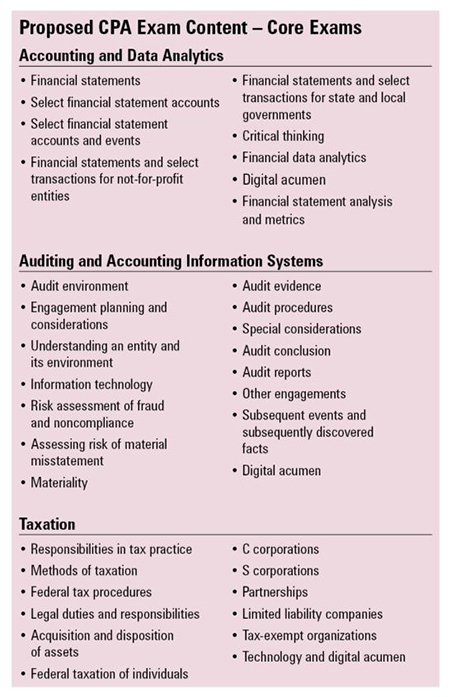

The New Improved Cpa Exam A Look Inside The Cpa Evolution Updates

Irs Transcript Transaction Codes Where S My Refund Tax News Information

Understanding Irs Transcript Codes H R Block

Where S My Refund 2020 2021 Tax Refund Stimulus Updates On My Transcripts It Shows That My Refund Had A Freeze Code 810 But Then Also Shows Tax Code 811 They Released

Irs Transcript Transaction Codes Where S My Refund Tax News Information

Meaning Of Irs Tax Transaction Codes On Wmr Irs2go And Account Transcript For Your Tax Return And Refund Status 150 151 152 203 420 421 570 846 898 971 1121 1161 Aving To Invest